Language

You can read the magazine in one of the following languages

The next time you splurge on a pair of shoes or a designer handbag with a price tag you’d rather keep to yourself, rest assured you may be able to turn that item into an investment that rewards you in two or five years. As an appreciating asset, this luxury item may have the potential to increase in value and, in the long-term, expand your wealth.

Accounting for seven per cent of the personal luxury goods market, the second-hand luxury market is anticipated to grow in the future. Some of the main reasons consumers are drawn to resale platforms are the seamless personalized digital experiences they offer. What’s more, the diverse price points for customers and financial opportunities for sellers deliver a win–win situation.

Among gen Z and millennial consumers there is undeniably a focus on sustainability and transient experiences that luxury pre-owned goods are also able to provide.

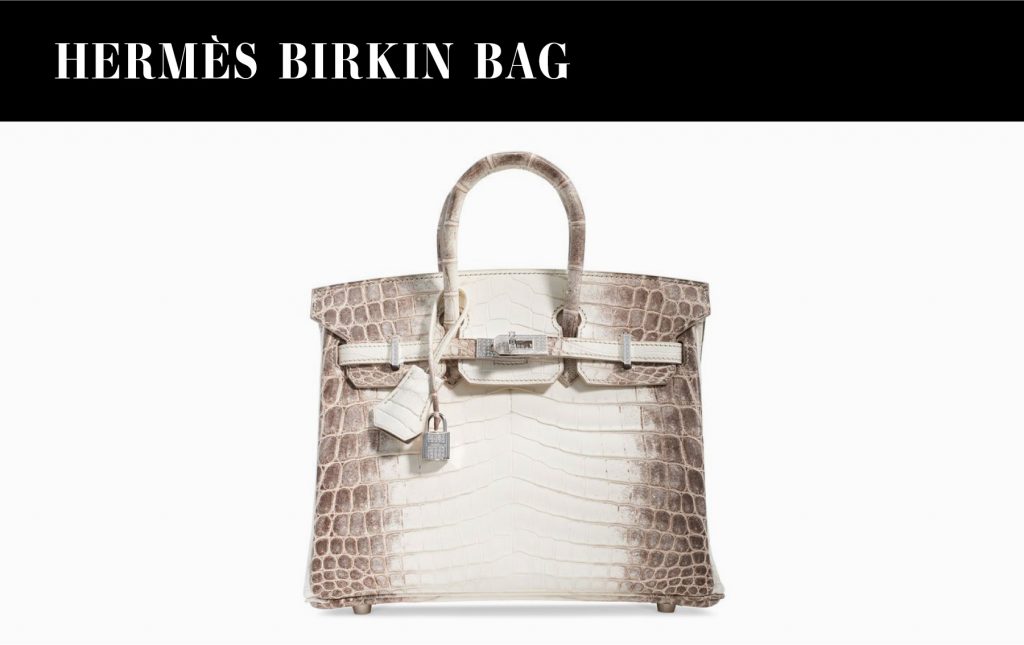

This iconic handbag represents the collaboration between the Executive Chairman of Hermès and British actor Jane Birkin who, rumour has it, developed the design for the handbag on a flight from Paris to London in 1984. Birkin was in fact seeking a bag that was suitable for her needs as a mother.

A year later, the Birkin bag was given form and today its hefty price tag reflects its value and the air of exclusivity surrounding it. Handcrafted in France, the luxury handbag is made using only premium materials.

In a study by luxury online retail platform Baghunter, the Birkin bag increased in value by 500 per cent over a 35-year period, which is partly due to its scarcity – potential customers are forced to join a queue for a product priced between US$40,000 to US$500,000. However, those willing to invest in a second-hand model will no doubt find premium prices in the thriving resale market. The fact that Victoria Beckham, Alessandra Ambrosio and Kate Moss have been spotted with the Birkin bag only adds to its perceived value.

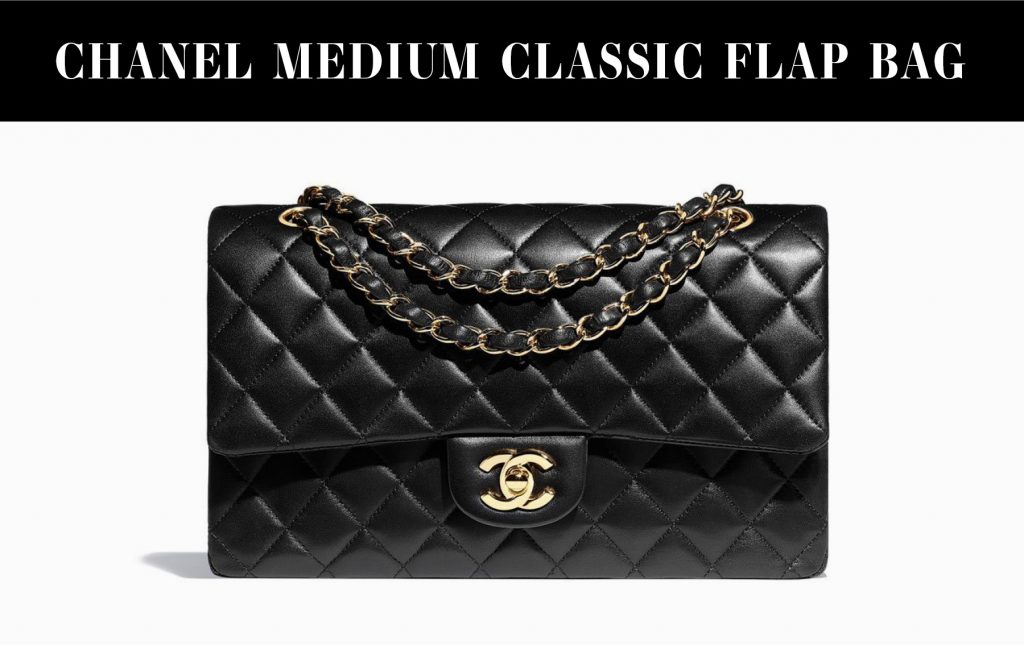

The simplistic shoulder strap bag was launched onto the market in 1955, making it one of Chanel’s oldest luxury handbags, with a price tag of US$220 attached to it back then compared to an astonishing US$8,800 in 2021. Between the years 2010 and 2015, the value of this highly sought-after commodity increased by 71.92 per cent.

As an investment piece, the brand’s exuberant prices over time merely suggest the exclusivity of the Chanel bag within the context of a booming secondary market, where demand is unlikely to drop. Alexa Chung, Rita Ora and Demi Lovato are some of its greatest celebrity fans.

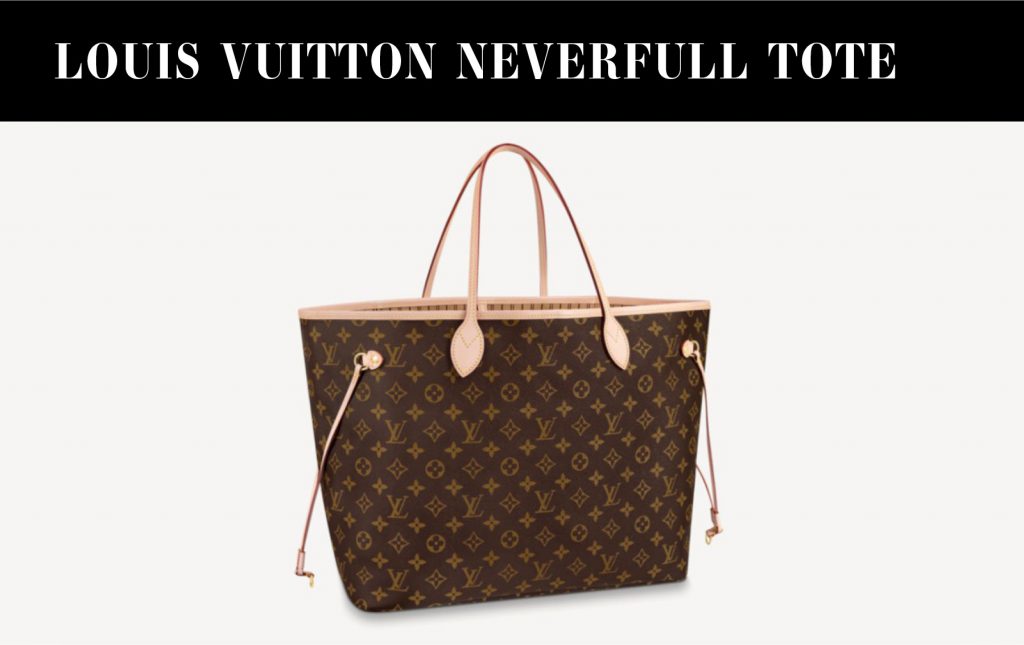

Introduced in 2007, Louis Vuitton’s iconic tote was designed to contain all your essentials. With its contrasting interior, it also offers full reversibility. With the help of celebrities, it has grown in popularity and sales, becoming one of the world’s most recognizable designer handbags.

At the same time, the brand introduced new material styles in addition to its monogram canvas – Damier Ebene, Damier Azur and Epi Leather. However, the limited-edition pieces that represent collaborations with artists Jeff Koons, Yayoi Kusama and Stephen Sprouse are likely to fetch higher sums.

The Louis Vuitton Neverfull MM (the middle size) increases in price on average each year by seven per cent. However, there’s also a thriving second-hand market where Neverfulls with a pouch attached perform particularly well. A Neverfull usually retains 85 per cent of its resale value, which is good news for investors.

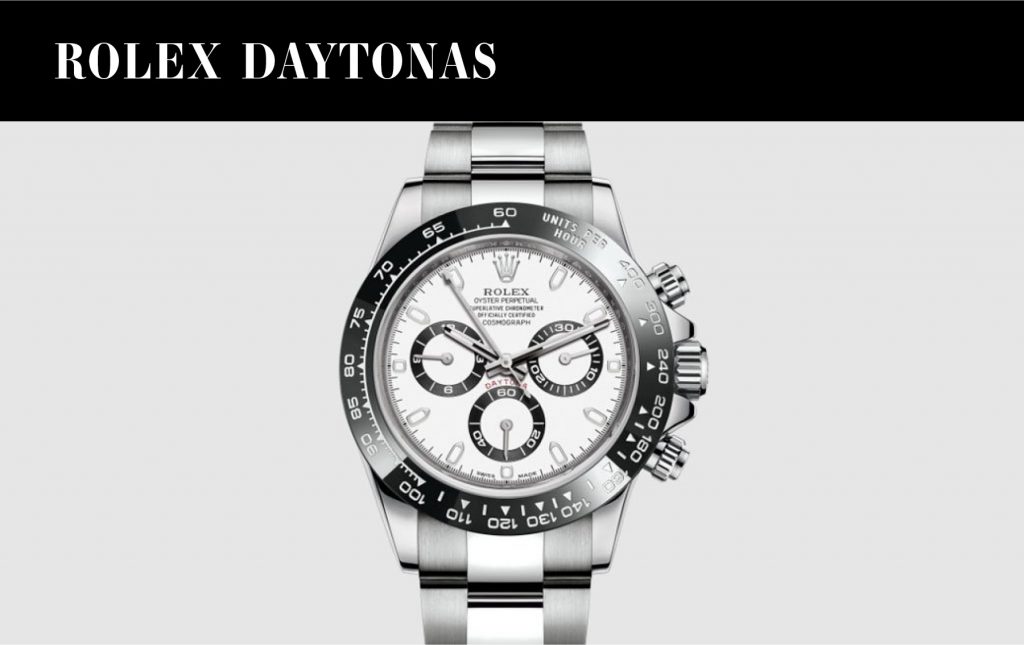

The Rolex story began more than 100 years ago when visionary entrepreneur Hans Wilsdorf created the first waterproof timepiece. Synonymous with Swiss precision and reliability, Rolex Daytona watches are a highly coveted commodity that consistently remain in high demand compared to the number of timepieces that are produced – an estimated 800,000 each year.

For this reason, the prices for pre-owned Rolex watches are likely to continue their upward trend relative to scarcity. The luxury watch market is currently worth US$20 billion and high-end Swiss watches like Rolex represent secure investments in the face of economic uncertainty. Investors could be gaining up to US$10,000 if they manage to secure a new Rolex Daytona.

The Cartier Love bracelet was conceived in 1969 by Italian jewelry designer Aldo Cipullo, who was inspired by medieval chastity belts. A symbol for eternal love, the bracelets require a special screwdriver to be removed and could originally only be purchased as a gift for someone. Initially valued at US$250, the iconic bracelets now range between US$1,600 and US$50,000 depending on the materials used. In 1969, Cipullo reportedly gifted high-profile couples with 25 pairs of bracelets. This classic statement piece retains its value as a result of the company’s longstanding reputation.

“What modern people want are love symbols that look semi-permanent – or, at least, require a trick to remove. After all, love symbols should suggest an everlasting quality,” Cipullo said.