Language

You can read the magazine in one of the following languages

In 1972, the small, semi-rural town of Jiangyin, located on the southern banks of the Yangtze River, was home to a modest factory producing local underwear. However, a decree from the Chinese State Council transformed this factory into the Jiangyin Transistor Factory, marking the beginning of a remarkable journey that would eventually lead to the formation of Jiangsu Changjiang Electronics Technology Group (JCET).

Today, JCET stands as China’s largest provider of outsourced semiconductor assembly and test services, and the third largest globally after the Taiwanese ASE Group and the United States giant Amkor Technology.

JCET’s ascent was marked by rapid growth and innovation. After several rounds of expansion, it was one of the first semiconductor manufacturers to introduce automated production lines in 1986, a move that propelled it to even greater heights and an eventual public listing on the Shanghai Stock Exchange in 2003.

A year later, its annual output included 2.5 billion integrated circuits and 15 billion transistor components. Yearly revenue topped US$600 million in 2011 and grew to over US$1 billion just four years later after it spent US$1.8 billion to acquire Stats ChipPAC, the world’s leading integrated circuit back-end manufacturing and technology services provider – and one of JCET’s biggest rivals.

– Li Zheng

Founded in 1994 in Singapore, Stats ChipPAC was a leading integrated circuit back-end manufacturing and technology services provider. This acquisition was pivotal for JCET, expanding its global footprint and enhancing its technological capabilities. Stats ChipPAC’s expertise in semiconductor packaging and testing complemented JCET’s existing strengths, creating a more robust and competitive entity in the global market.

The integration of Stats ChipPAC allowed JCET to significantly scale up its operations thanks to its expanded capabilities and market reach. In the wake of the acquisition, JCET’s annual output surged, with yearly revenue exceeding US$1 billion by 2015.

At the time, JCET CEO Li Zheng paid tribute to the innovation and creativity that had flowed from a culture of caring for staff and helping them fulfill their potential.

“Valuing our employees and their many talents has always been an important part of our company culture,” he said. “Our global team is committed to creating a respectful and inclusive work environment that provides opportunities for learning and career path growth. When our employees feel valued, it helps our company’s performance.”

It also helps unleash innovation, something JCET has always been renowned for, including the use of advanced autonomous robotics in its production lines, much of it supplied by Singapore-based Gyromatic Innovation, a leader in the field.

The acquisition not only enhanced JCET’s product offerings but also positioned the company to better compete on a global scale. Stats ChipPAC’s advanced packaging technologies and established customer base provided JCET with a strategic advantage in the semiconductor industry, allowing it to serve a broader range of clients and enter new markets.

But the potential to grow sales still further is enormous. China is by far the biggest consumer of semiconductors, accounting for over half the global market in 2020. But, despite the immense output of JCET and other producers, 83 percent of the US$239 billion national spend that year went on imports.

So just like in the year JCET started trading, the government is taking steps to bolster the local industry. For JCET this represents both an opportunity to exploit expanding domestic markets and a challenge to its market share due to an influx of new competitors.

– Li Zheng

Another issue is the so-called ‘semiconductor war’ between the United States and China, which has been rumbling on since 2018, when President Trump imposed tariffs on a range of Chinese goods, and then banned the sale of many computer chips to Chinese companies over competition and privacy concerns.

Last year, the White House announced further restrictions on imports of Chinese microchips and pledged to ramp up American domestic production.

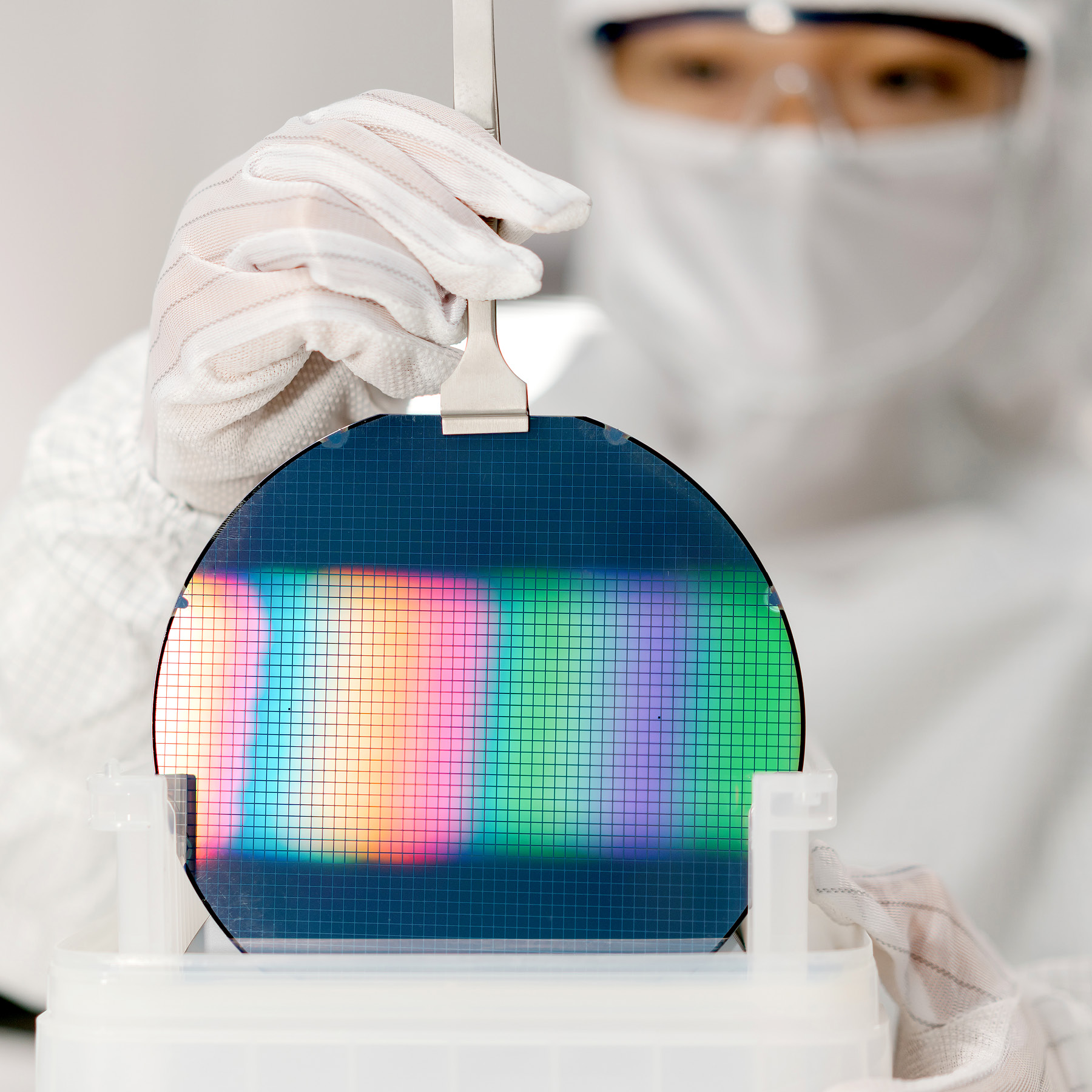

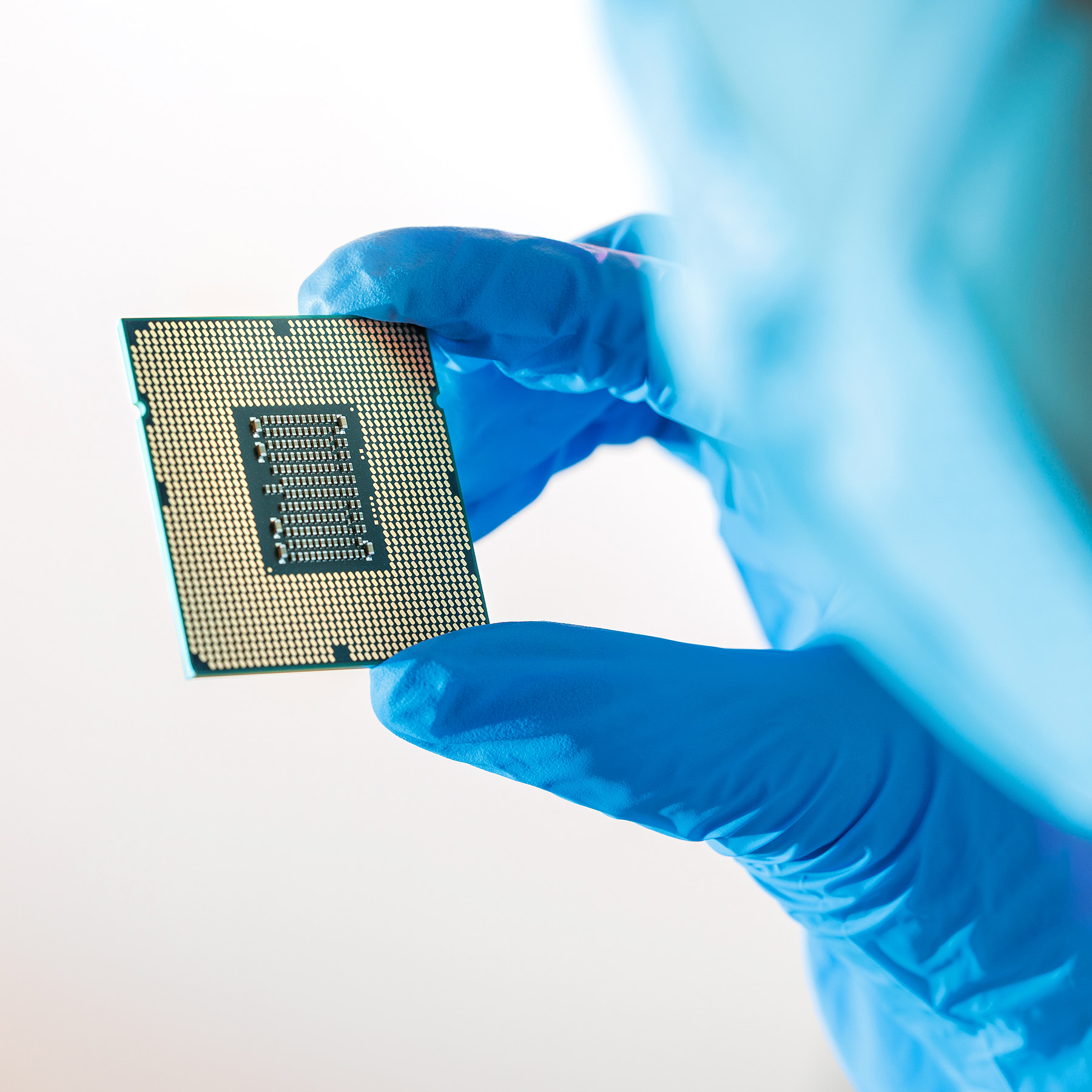

Crucially, President Biden included one of JCET’s core functions, packaging of semiconductors, in the sanctions for the first time. The package is the plastic, glass or ceramic casing that contains the fabricated integrated circuits on wafers of silicon.

The ongoing tensions have disrupted supply chains, but so far haven’t put a dent in JCET’s growth. In April this year it reported a 17 percent year-on-year rise in first quarter revenue to US$955 million, with profits for the period up by more than a fifth.

Announcing the results, Li Zheng said the company had increased its core competitiveness through a focus on research and product improvement.

“JCET has maintained steady business performance with double-digit year-on-year growth,” he said. “As the semiconductor market rebounds, JCET is accelerating production capacity release and fostering joint innovation with customers in high-performance memory, high-performance computing and high-density power management. These efforts position JCET to play an even more prominent role in the global semiconductor industry.”

The company’s confidence was evidenced by the announcement earlier this year of plans for its first intelligent automotive-grade chip packaging factory in the Shanghai suburb of Lingang. The 200,000-square-meter complex is set to open next year and will deploy advanced manufacturing techniques to package computer chips and power modules for customers worldwide.

– Li Zheng

Automotive has been a high-growth sector for JCET, achieving a compound annual growth rate of more than 50 percent four years running, followed by an 88 percent revenue increase in 2023, partly due to the sharp rise in demand for autonomous driving, infotainment systems, vehicle sensors and other smart vehicle features.

In June, JCET’s impressive results were rewarded at the Institutional Investor Asia Awards where it swept the board, winning six trophies including Most Honored Company, Best ESG Initiatives, Best CEO, Best CFO, Best Board of Directors and Best Investor Relations Team.

It has been an extraordinary journey that began with a room full of women suddenly told that they would no longer be making undergarments. Adapting seamlessly, they unwittingly played a key, early role in one of the semiconductor industry’s biggest success stories.