Language

You can read the magazine in one of the following languages

Geolocation

You can read the global content or the content from your region

The mortgage industry continues to face unprecedented circumstances, and the future of the housing market remains uncertain.

As lenders navigate these challenges, companies are looking for allies in the industry – innovators that adapt to change and deliver customizable solutions for every line of business to best serve consumers.

From loan origination to loan servicing and even selling that loan, top lenders, servicers and investors choose Mortgage Connect every day to provide unparalleled service.

Mortgage Connect is the premier end-to-end mortgage services provider for the industry, providing innovation, efficiency and cost savings to its clients. It is a national mortgage services provider that supports lenders, servicers, and institutional investors by providing solutions for the entire mortgage lifecycle.

Led by an accomplished leadership team of industry experts, Mortgage Connect offers customizable services and solutions for all lines of business within originations, servicing and capital markets.

Its end-to-end product offerings span across the mortgage continuum and include services like title and closing, valuations, capital markets, pre and post-closing quality control, loan modification, loss mitigation, default and document solutions.

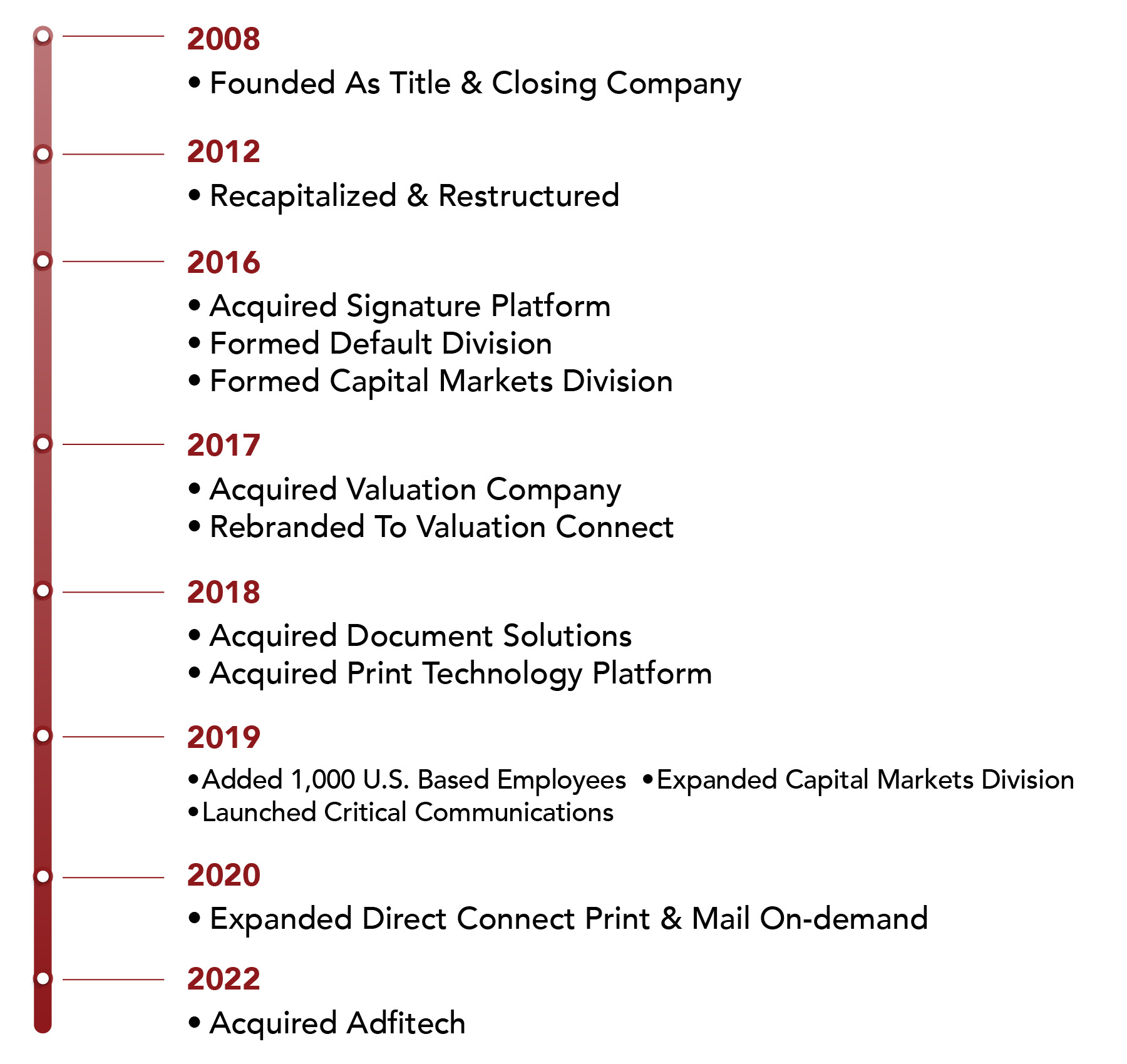

The company was founded in 2008 with a primary focus on the consumer experience. The relationship Mortgage Connect has with its customers revolves around the shared interest of how to best serve the consumer through education, communication and operational expertise. This consumer-centric approach has remained at the company’s forefront for the past 15 years.

CEO of Mortgage Connect Jeff Coury has carried out this philosophy since assuming the role in 2012. “Our goal has always been to deliver an unparalleled consumer experience while reducing compliance risk and ensuring operational excellence at any capacity,” explains Coury.

Coury’s unwavering passion for the consumer and commitment to operational excellence is the foundation that grew Mortgage Connect into the industry’s largest independent mortgage services provider.

Since 2012, Coury has expanded the company’s services beyond its initial title and closing offerings to provide the most comprehensive mortgage service offerings in the industry. “In the past 15 years, we have grown our product offerings and positioned ourselves as a one-stop-shop for our clients,” Coury explains.

Regardless of the service offering, the core priorities for the company’s success remain the same.

Mortgage Connect demonstrates the strongest operational execution in the industry. Utilizing client-dedicated teams and an innovative vendor management model, service level expectations are exceeded with the utmost quality and efficiency.

By adopting a single-point-of-contact model, clients communicate with a dedicated team member who is well-versed on their specific requirements. “We strive to form strong partnerships with our clients to better understand their needs and how we can help,” states Bob Franco, President of Mortgage Connect.

Though the entire company values the importance of an extraordinary consumer experience, it is a focus that Cristy Ward, Mortgage Connect’s CSO, is passionate about.

As the architect of the industry’s first enhanced closing model, Ward leads Mortgage Connect through a comprehensive approach to the consumer experience utilizing digitization, education and communication. “Understanding what the consumer wants allows us to tailor our business model,” Ward explains.

In today’s digital world, consumers expect instant communication and immediate results. Through proprietary technology platforms and mobile applications, Mortgage Connect provides real-time updates to keep the client and consumer informed at every step of the transaction.

Technology plays a crucial role in every line of business, and the mortgage industry is no exception. Mortgage Connect is constantly developing innovative ways to provide a seamless digital experience.

“Automation and machine learning are changing the mortgage landscape. Our goal is to automate as much as possible to make workflows more efficient” says Gabe Minton, CTO at Mortgage Connect.

Minton and his team are implementing AI and automation tactics on multiple fronts – adopting multi-title engines to automate title decisioning, testing with GSEs to expand available data and appraiser technology and tracking the creation, printing and shipping of physical documents.

Change is the only constant on the horizon for the mortgage industry, and Mortgage Connect plans to keep driving innovation forward to adapt to these changes.

The company continues to embrace the digitalization of the mortgage process and create new efficiencies driven by AI and automation, all while keeping the consumer experience top of mind.

It has never been more important for lenders to have a trusted partner that can deliver exceptional service and new ways of operating. Mortgage Connect continues to rise to the occasion and prove itself as the most trusted mortgage services provider in the industry.