Language

You can read the magazine in one of the following languages

Geolocation

You can read the global content or the content from your region

When Tjandra Gunawan first joined Bank Neo Commerce (formerly known as Bank Yudha Bhakti) in March 2020, his start coincided with a number of major challenges, including the global COVID-19 pandemic and new capital requirement rules, which hit small banks like his hard.

Instead of letting these challenges derail his ambitious plans for the bank, Gunawan saw it as an opportunity to take on his bigger rivals, digitalize the bank and bring in new people.

“We are making sure that our technology is becoming something that is relevant to customers.”

“I gathered all of my executives and all of my directors in one room and I said to them, ‘Guys, the world is changing. So I think this is the right battlefield for us. You know lots of big banks in Indonesia already, the big boys, you see them occupying the market in Indonesia’,” he says.

“‘This is the right timing for us to make a move. This is like a giant wave. COVID-19 is like a giant wave. This is also an opportunity. Let’s learn how to ride a wave, how we can become surfers’.”

While many big banks were closing branches, Gunawan was looking at new ways of reaching customers using technology.

“To me, the technology in digital banks is becoming the backbone. In fact, I might say in an extreme way that I prefer that the digital bank is a technology company, specializing in banking.”

However, he is careful not to integrate technology into banking just for the sake of it, without testing its usefulness first.

“We are making sure that our technology is becoming something that is relevant to customers. So we are finding out their needs and their wishes through our database and we are always in constant communication with our customers,” he says.

Gunawan has observed that lots of the customers are excited about Bank Neo Commerce’s digitalization, even if they don’t fully understand digital products.

“So we are giving them education on the products, on the features, on what actually is a digital bank. And at the same time also convincing them that the security of the digital bank is there,” he says.

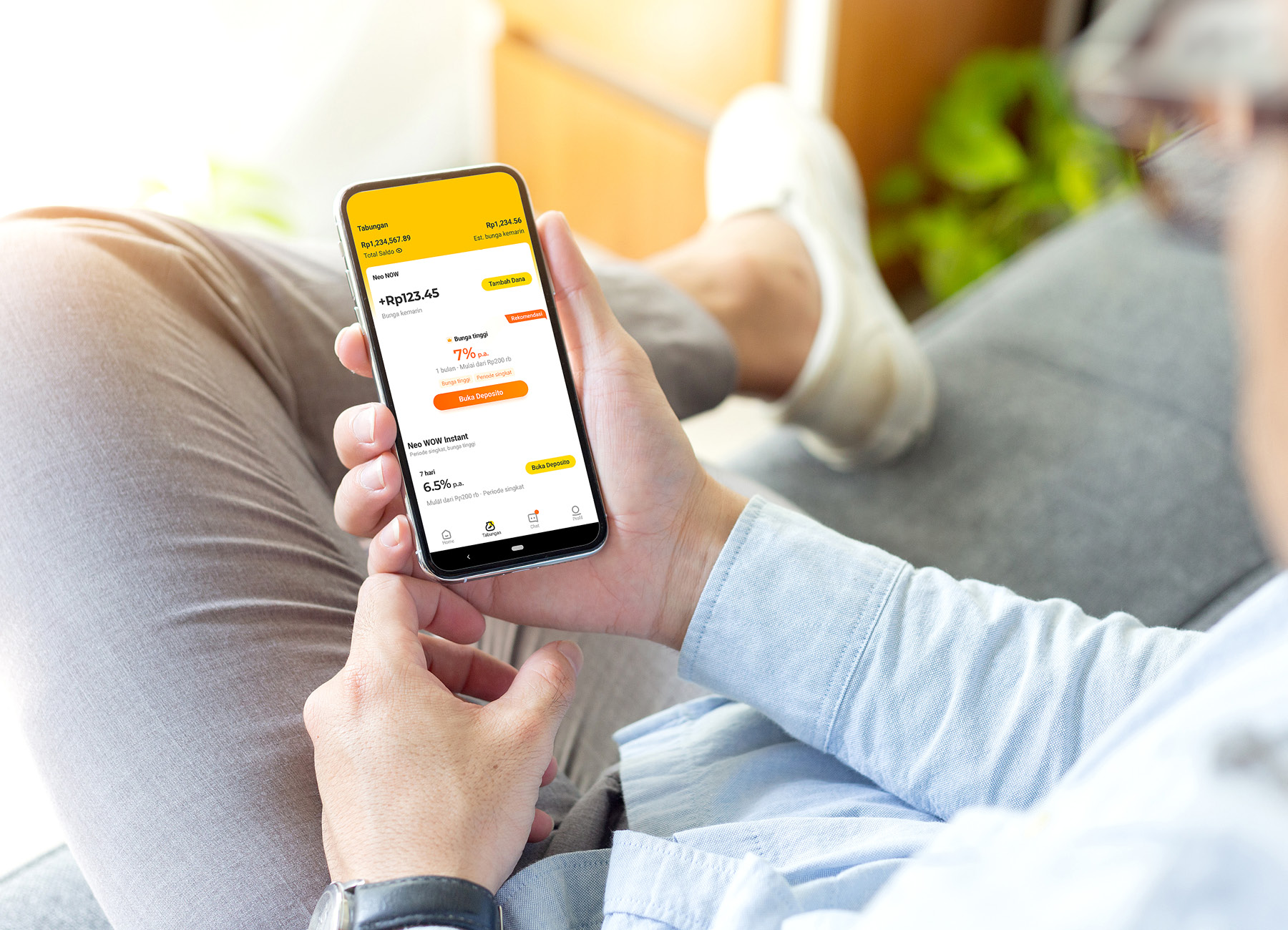

He is proud that he and his team have successfully built not just a brand name, but also an app that is being used by close to 20 million users. “We believe that our presence in Indonesia has started to reach out to the un-banked and under-served in Indonesia,” he says.

As he pushes ahead with digitalization, Bank Neo Commerce has become what Gunawan calls “a trendsetter bank, rather than a follower bank” in Indonesia. This new energy and innovative environment has helped him bring new staff and introduce new ideas, which are being followed by other digital banks.

In the process of transforming his traditional bank to a digital one, Gunawan learned that even with all the technology, the most important element is actually people.

“Lots of people think that transforming a digital bank should start from the technology, from the platform, from the hardware, software. No, actually, the transformation should start from the people first,” he explains.

“Lots of people think that transforming a digital bank should start from the technology, from the platform, from the hardware, software. No, actually, the transformation should start from the people first.”

Not just in terms of bringing in the right people, but changing the mindset of the bank’s existing staff.

“Once we successfully transform the mindset of the people, then transforming the bank becomes easier, because we need to have the right team, we need to have the right people, in the right positions, with the right mindset, then we are ready for the battle,” he says.

While having the right people is crucial, this extends to suppliers and business partners. “We maintain a very good relationship as well as synergy with our suppliers and business partners because we are using lots of their technologies, including the hardware ones,” he explains.

“You can imagine that if we were transforming a bank with unreliable supplies, the services and products that we would bring to market would not be the absolute best quality that we strive for.

“We want to give the best features, the best product, the best services to the markets, even though we are a new player. We need to be very prominent, and have suppliers that understand our needs and share the same vision with us.”