Language

You can read the magazine in one of the following languages

Geolocation

You can read the global content or the content from your region

Despite the turbulence being felt widely across a global economy sullied by war, climate change and inflation, there remains a constant – the rise of India. As the fastest-growing economy in the G20, it has now surpassed the United Kingdom as the fifth largest in the world and shows no sign of slowing down. Like many of the nation’s industries, the future is bright for India’s financial sector.

As India develops, its digital revolution will continue to accelerate, and with it so will financial inclusion. In 2022, Indian fintech startups raised US$5.65 billion. For firms such as HDFC Securities, which has long served as the investment and trading wing for its core banking customers, this brings exciting new opportunities. Since 2017, it has grown into a unique platform catering to different broking and wealth management segments.

“We had a great opportunity where our solutions were ready for existing customers who were largely acquired and serviced through HDFC Bank. But now we are in a position to introduce our new fintech platform, which is largely driven by the DIY model,” HDFC Securities COO and CDO Sandeep Bhardwaj tells The CEO Magazine.

The firm’s incredible growth is propelled by Millennial and gen Z customers that are demanding tech-driven investment platforms. In fact, it was this development that initially attracted Bhardwaj to HDFC Securities.

A banking, financial services and insurance (BFSI) veteran of 23 years, Bhardwaj understands that Indian stockbrokers are enjoying a watershed moment, which may help HDFC Securities leapfrog the competition. At such a delicate juncture, no company would want to lose its shot at capitalizing on this opportunity.

“The industry is witnessing good growth. Today, we have close to 111 million demat [dematerialization] accounts,” he says. “If you look back at 2019, this was roughly 30 million. We’ve practically seen 80 million accounts added in the last three and a half years, which itself suggests the kind of growth India, at large, has seen.”

As a result, Bhardwaj is planning to make HDFC Securities more accessible by pioneering a product-first company within a service-based industry. In order to acquire a larger market share in the next few years, he’s betting on an experience-led DIY model – HDFC Sky.

HDFC Sky is broader in its reach than HDFC Securities and caters to new-age investors who prefer to tinker with their portfolio and enjoy more control over their instruments. “We’re ensuring that HDFC Sky fully caters to the needs of our youth with constant updates which make investing simpler and faster,” he says.

“The rapid strides we’re already making offer a glimpse into the dynamic future that awaits.”

At the same time, HDFC Securities continues to provide assisted services through experienced relationship managers, which are more suited to its traditional user base. But developing an all-in-one digital framework for investment, decision-making and tracking is only one aspect of HDFC Securities – Bhardwaj is also focused on navigating the complex regulatory challenges to deliver stable financial results.

Despite new frontiers and challenges to conquer, Bhardwaj hardly looks out of his depth. Before joining the company, he had 13 years of capital markets experience, including his role as CEO of IIFL Securities. Over the years, he has observed the evolution of customer needs and demands. In this current role, he has used digital data and analytical tools to gain a detailed insight into the minds of his clients.

“This age is all about experience-led innovation, where the customer is looking at how they can get the best experience,” he says. “But at the same time, they also keep looking for what’s new.”

The level of trust in HDFC Securities is also high among its staff, Bhardwaj adds. “I’m very happy and proud to announce that the average tenure of our employees is more than a decade. It means not only customers but also our employees trust the brand.

“Building up their skills, and keeping them relevant and motivated are our top priorities. At the same time, we acquire the best industry talents, fostering a culture of innovation and collaboration.”

However, complacency can seep in quickly when you know a positive reputation may obscure organizational flaws. Bhardwaj knows this, and he takes the weight of the name as a responsibility to build trust.

“We always believed in building up a core value system where we prioritize integrity and transparency,” he says. “This is the value framework that we have designed for our organization and used to serve customers.”

An ecosystem of customer-centricity, innovation and accountability has helped HDFC Securities stand apart and stand tall among its competitors. Its tech stack puts it ahead of other legacy institutions and its brand value outshines new-age fintech startups.

In the long run, however, a brand name cannot sustain the ecosystem alone – you need strategic partnerships, especially in highly regulated sectors.

“In a tightly integrated industry where you are leveraging many partners, if one of the service lines fails, it directly impacts your customer. The best-in-class customer service can only be achieved by leveraging the entire ecosystem,” explains Bhardwaj.

He argues this is how consistent service can be provided to customers who often worry about extended downtime or frequent outages. For him, it truly takes a village to serve his customers.

But you don’t get to build that support system in a day. Bhardwaj lays out key initiatives that help nurture partnerships in his company, which are both detailed and comprehensive. These range from risk management analysis, to a collaborative planning approach that leverages each other’s strengths, to an initiative for continuous improvement to absorb learnings. These are just a handful of strategies that encourage committed, long-term partnerships.

In a carefully crafted digital financial ecosystem, every partner needs to function to deliver a flawless experience to customers.

“When we get into the periodic meetings, we get feedback from each other, what we can learn from them, what they can learn from us and we remain on track to complete our tasks and deliveries,” says Bhardwaj.

Looking at the engine that powers HDFC Securities, it’s difficult to find an area that doesn’t require domain expertise and reliable service. Some of the capabilities are built in-house, but Bhardwaj tries to leverage his partner ecosystem whenever it’s needed.

Just like the talent management and product development strategies, Bhardwaj is a big believer in balancing the old with the new. HDFC Securities has several long-term partners who’ve been working for years, yet this doesn’t deter the company from seeking out new-age vendors to integrate new ideas.

One of them is SnapWork, a software development company focusing on the digital transformation of BFSI giants. SnapWork has reworked the application and user interface of HDFC Securities, helping everyday users track their portfolios easily.

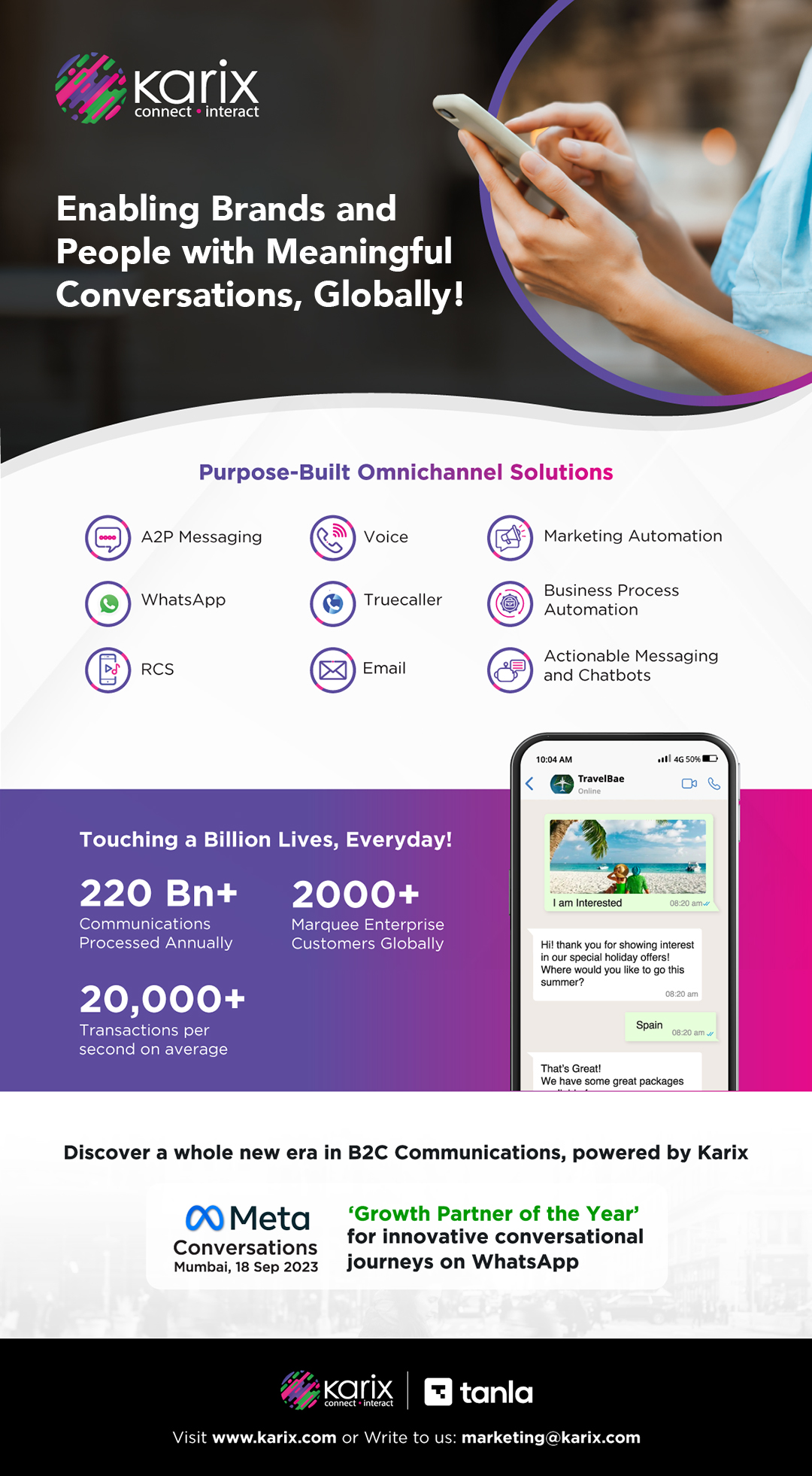

Tanla Platforms is another forward-thinking partnership that offers bespoke cloud messaging and corporate communication stack. It runs an anti-phishing technology called Wisely, which is offered as a communications platform as a service to leading private banks.

HDFC Securities is facilitated by a huge network of partners who help it stay up-to-date with changing customer behaviors. Since a foundation has already been set, Bhardwaj now wants to scale-up quickly for the new generation.

“I feel in this changing world, being relevant is the most important thing,” he says. “We cannot look back at our past experiences, at what worked 10 years ago.

“The world is moving forward, and we need to be relevant to our customers today.”