Language

You can read the magazine in one of the following languages

Dubai’s branded real estate market has become a popular destination of choice for the world’s richest to invest their wealth.

Overtaking the previous leader, South Florida in the United States, the United Arab Emirates city has nearly four dozen of these properties, with many more in the pipeline for construction before 2030, according to a recent report by real estate company Savills.

Developers are teaming up with luxury names such as Four Seasons, Bulgari and Cavalli to create apartments that can sell for around 30 percent more than non-branded counterparts, depending on the region. Consumers get to enjoy the higher level of amenities and security the name provides, while in return, the brands get paid a commission from the developers and an annual management fee.

In April, a buyer agreed to pay US$55.3 million for a Baccarat-branded five-bedroom apartment in a project that has not yet broken ground. This beat the previous cost per square meter record set in February by the sale of a five-bedroom apartment in the Bulgari Lighthouse, which sold for US$43.6 million.

Scott White, the Chief Executive of Pragmatic Semiconductor, is calling on the United Kingdom government to invest further in the semiconductor industry. He says that without a substantial funding boost, firms in the United Kingdom will go abroad.

This comes as the world is beginning to recover from two years of semiconductor shortages, which disrupted supply chains and the entire electronics industry. The impact was felt by people across the globe – from those wanting the newest Tesla to those just trying to get hold of basic consumer electronics.

A joint report by the Institute of Physics and the Royal Academy of Engineering found that the government “must act now to secure the future of the vital United Kingdom semiconductor industry”. The report also found that skills shortages, high costs and low public awareness are key threats to the sector.

However, White warns that a few tens of millions of pounds from the government will not be enough to move the needle.

“It has to be hundreds of millions, or even more than £1 billion [US$1.2 billion], to make a substantive difference. It is not about unfair subsidies, it is about having a level playing field with other countries around the world.”

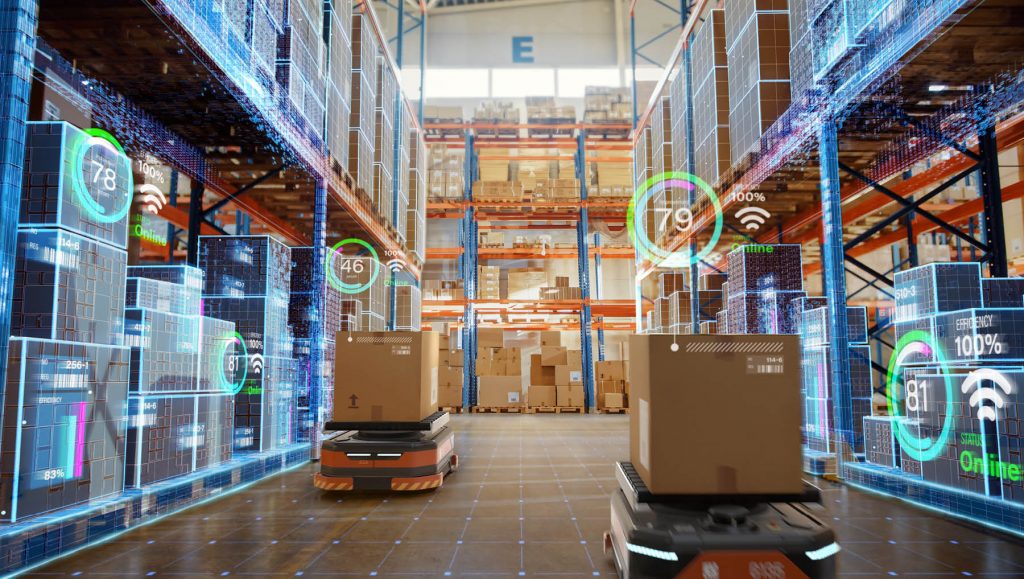

A recent study by parcel delivery service CouriersPlease has revealed that 90 percent of Australian online retailers plan to invest more in their businesses to protect against current economic pressures.

Other findings from the study show that 42 percent of retailers plan to expand their product range, 34 percent plan to invest in marketing and 31 percent also plan to implement new technology such as chatbots and automated warehouse fulfillment.

“Online retailers are still enjoying the positive effects of the ecommerce boom, and total revenue for the Australian market is forecast to continue growing steadily year-on-year, with the market projected to reach US$35 billion by 2025,” CouriersPlease CEO Richard Thame said in a press release.

“But the survey shows that retailers are not naive to economic fluctuations and are acting now to prepare for potential future challenges.”

Are you new to the world of investing, or do you just want to find ways to level up your skill? Here are five books we recommend to get you started.