Language

You can read the magazine in one of the following languages

In today’s rapidly evolving financial landscape, adaptability and innovation are key.

Brim Financial, a Toronto-based fintech, is leading the charge with its pioneering ‘Platform as a Service’. This comprehensive solution is transforming the way banks, fintechs and large brands manage and launch credit card programs, making it easier than ever to provide customers with cutting-edge financial services.

Credit cards are a cornerstone of modern financial services, offering numerous benefits to both institutions and consumers. For financial institutions, credit cards are a significant source of revenue through interest payments and fees. They also provide valuable data on consumer spending habits, which can be used to tailor financial products and services to meet customer needs better. Furthermore, credit cards enhance customer loyalty by offering rewards programs and other incentives that encourage repeat usage.

For businesses, credit cards are indispensable in helping them operate more efficiently by meeting the needs of everyday operations through improved cash flow management. Cards can provide insights on corporate spending and a better understanding of working capital needs.

For consumers, credit cards offer convenience, security and financial flexibility. They enable quick and easy payments, provide a buffer in times of unexpected expenses and often come with benefits such as travel insurance and purchase protection. Given these advantages, a robust credit card offering is essential for any financial institution aiming to remain competitive and meet the diverse needs of its customers.

Launching a credit card program has traditionally been a complex and resource-intensive process, often requiring significant investment and time. Brim Financial addresses these challenges head-on by offering a turnkey solution that allows for rapid deployment of branded credit card programs. This means financial institutions can bypass the usual hurdles and quickly introduce modern, seamless credit card services to their customers.

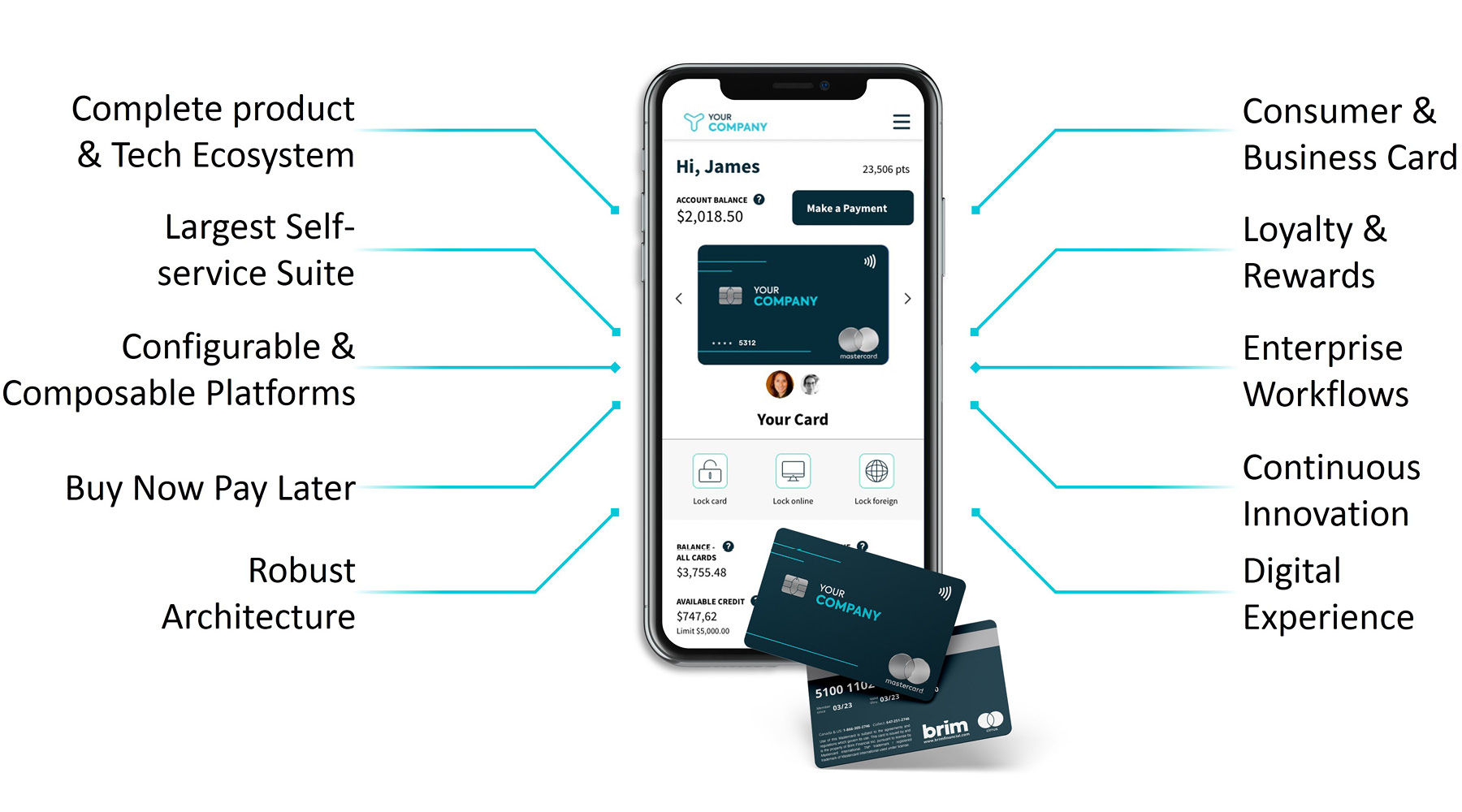

Brim’s platform offers a comprehensive suite of features tailored to meet the unique needs of businesses. Real-time expense tracking, automated reconciliation and detailed analytics all help in making informed financial decisions.

Brim’s integration capabilities also mean that businesses can seamlessly connect their card programs with existing financial and accounting systems, reducing administrative burden and enhancing efficiency.

“Our goal is to empower financial institutions with the tools they need to compete in today’s digital-first world,” says Rasha Katabi, CEO of Brim Financial. “We provide a flexible, scalable platform that allows our partners to deliver exceptional value to their customers quickly and efficiently.”

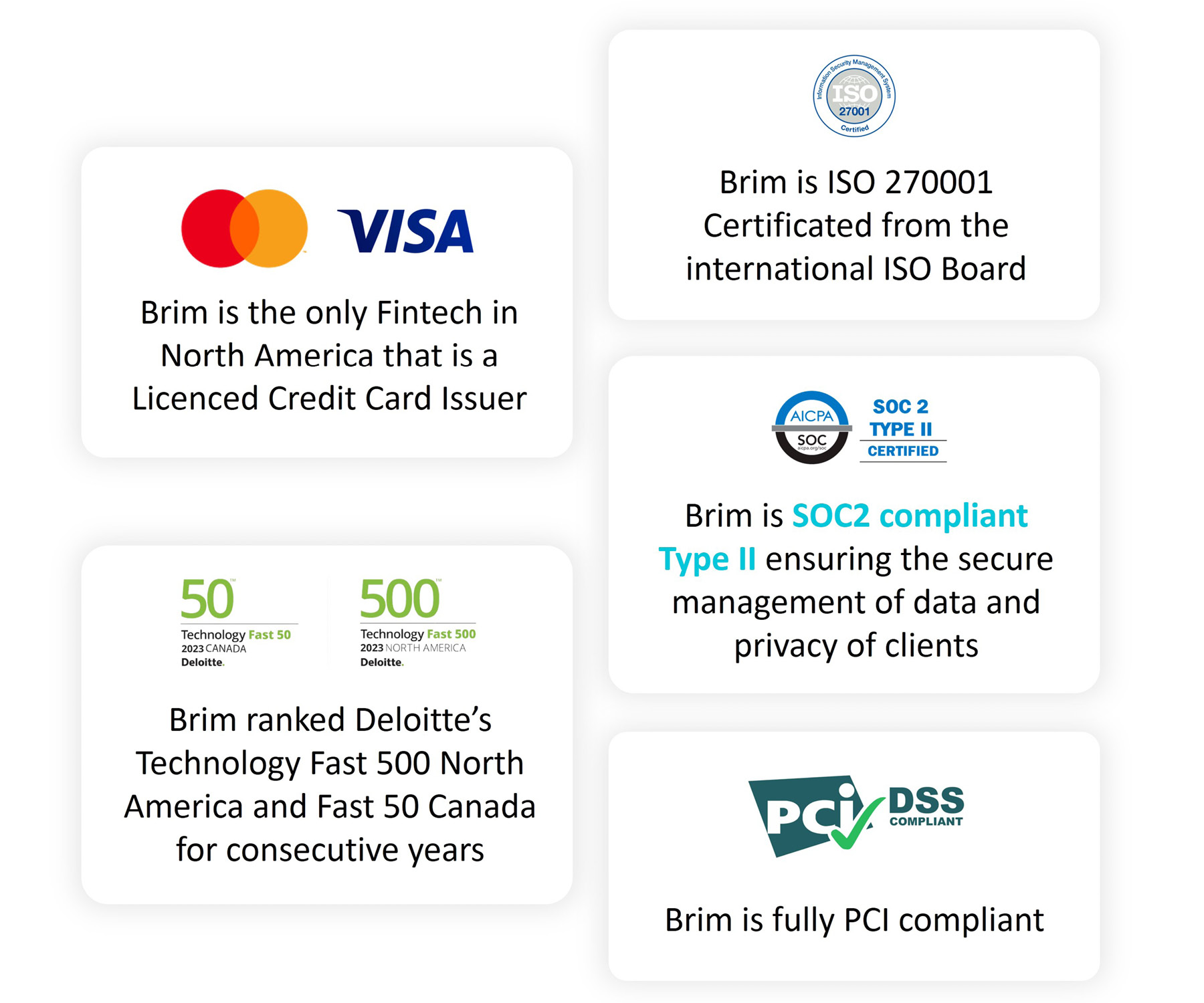

Brim Financial has partnered with many stakeholders, such as Mastercard and other networks, to integrate state-of-the-art digital features into its platform. This collaboration ensures that all transactions are not only smooth but also highly secure. The platform’s robust security measures foster trust and reliability among users, essential in today’s cybersecurity conscious environment.

In addition to security, Brim’s platform offers dynamic reward options tailored to the diverse needs of modern consumers. This ensures that cardholders remain engaged and satisfied, enhancing customer loyalty and retention.

Beyond managing transactions, Brim Financial’s platform excels in providing deep insights into customer behavior. Its advanced data analytics capabilities allow institutions to understand their customers better, enabling them to tailor their offerings and improve customer satisfaction. By leveraging these insights, institutions can deliver more personalized and effective services, driving loyalty and engagement.

A key strength of Brim Financial’s platform is its scalability. Whether implemented by a small bank aiming to grow or a large brand looking to expand its financial services, the platform adapts to the institution’s needs. It evolves with the business, ensuring it can meet increasing demand and stay ahead of market trends. This flexibility makes it an ideal solution for institutions at any stage of growth.

Adopting Brim Financial’s platform means more than just offering a credit card; it’s about transforming the entire customer experience. With streamlined operations, enhanced security and personalized offerings, financial institutions can differentiate themselves in a crowded market. This transformation leads to a comprehensive financial ecosystem that addresses the evolving needs of today’s consumers.

Brim Financial is paving the way for a new era in financial services. By embracing this innovative platform, institutions can overcome traditional barriers and offer cutting-edge solutions that enhance customer engagement and loyalty. As Katabi emphasizes: “We are committed to helping our partners succeed by providing them with the technology and support they need to thrive in a digital world.”